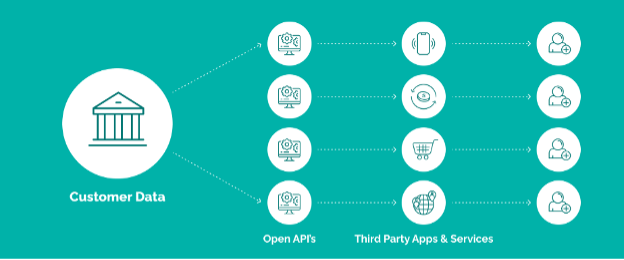

Simply open banking allows access and control of consumer’s banking and financial accounts through third-party applications.

It is also referred to as “Open bank data”. This practice will allow third parties providers TPP and financial service providers open access to consumer banking, transactions, accounts and other financial data using APIs. This innovation is poised to reshape the banking industry.

Such access to open data is granted after the consent of the consumer that allows the banks to share their data. Third party providers APIs can then use the costumer’s shared data. Uses might include comparing the costumer’s accounts and transactions history to provide target marketing profiles or making new transactions and account changes on the customer’s behalf.

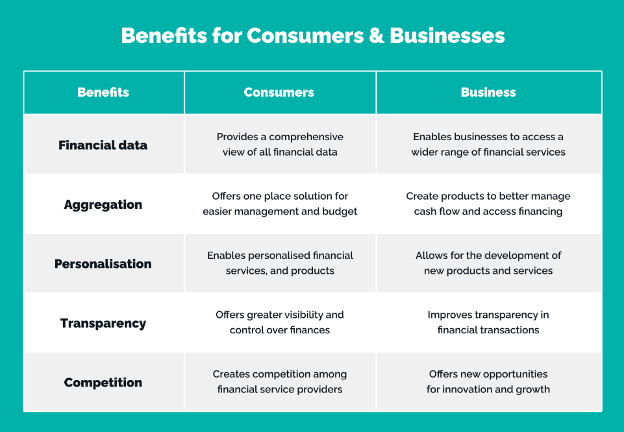

Open banking centralization can facilitate the onerous process of switching customers’ checking accounts service from one bank to another having better service or Saving account that would earn a higher interest rate than the current account or a different credit card with a lower interest rate.

With networked accounts, open banking could help lenders get a more accurate financial situation of a consumer and risk level to offer more profitable loan terms. An open banking app could calculate what a customer can afford based on their information and might provide a more reliable picture than mortgage lending guidelines currently provide. Open banking can also help small businesses save time through online accounting and help fraud detection companies better monitor transactions and accounts to identify any problems sooner.

Open banking will push up the competition between banks and ideally result in lower costs, better technology and better customer service. In addition, banks can benefit from this new technology to strengthen customer relationships and customer retention by helping their customers to manage their finances instead of simply doing daily transactions.

Risks of Open Banking

All the benefits from an open banking network might also pose severe risks to financial privacy and security of customers’ finances resulting liabilities to the financial institutions. An extreme threat example would be a malicious third-party API could clean out costumers account (less likely). What is more likely and broader risk is a simple data breach due to poor security, hacking or inside information leakage which becomes more widespread in the current modern era.

The rules for open banking can be complicated because they vary from one region to another. For example, in Europe, there are specific regulations like PSD2 that financial institutions and Third-Party providers must follow. When these organizations operate in different countries, they face challenges in meeting all different rules.

It can be hard for these institutions to make sure their systems work together while also following various regulations. Additionally, enforcing open banking standards and holding companies accountable for not following the rules is difficult, especially when services cross into different regions. This situation shows the need for clearer international standards and better cooperation among regulators.

To handle these challenges, organizations need to develop strong compliance strategies and invest in technology that helps them keep up with the rules.

Banking industry disruption

While customers may find that open banking offers better overall banking experience, it can also disrupt the banking sector. Increased competition puts pressure on traditional banks to improve their services, reduce fees, and innovate. Banks with older technology might struggle to keep up with open banking due to technical challenges and the high costs of upgrading their systems, making it harder to compete with more flexible fintech companies. Open banking also reduces the need for intermediaries in financial transactions, meaning traditional banks could lose out on fees and revenue from things like loan origination.

However, open banking doesn’t have to create a conflict between new fintech companies and traditional banks. Instead, these institutions can work together in ways that benefit both. By collaborating, traditional banks can stay competitive, innovate, and expand their services. Partnering with fintech allows banks to offer a wider range of products, better meeting customer needs and reaching new markets or demographics. Open banking presents opportunities for both sides to strengthen and complement each other’s offerings.

Top open banking Apps for 2023

Plaid

Plaid is a fintech company that provides a suite of APIs for financial institutions and fintech companies. With connections to over 11,000 financial institutions in the US, Plaid allows businesses to securely access customer data and build innovative financial services and products. Its key features include transaction data, account balances, and authentication. Its products enable developers to build applications connecting users’ bank accounts, credit cards, and other financial accounts. Companies like Venmo, Coinbase, and Robinhood use Plaid for innovative technology solutions. In 2020, Plaid was acquired by Visa for $5.3 billion.

Tink

A Swedish-based open banking platform that connects financial institutions to over 3,400 banks across Europe. Its APIs enable businesses to access account data, initiate payments, and verify customer identity, among other features. Its platform provided account aggregation, payment initiation, and personal finance management tools. Tink has partnered with major financial institutions such as PayPal and BNP Paribas and has a strong market position in the European open banking landscape. In 2021, Tink was acquired by Visa for $2.15 billion.

Yapily

A London-based open banking platform that provides APIs for businesses to access banking data across the UK, Europe, and beyond. Its platform enables businesses to access bank account data, initiate payments, and verify account ownership, all through a single API. Yapily currently serves over 2,000 businesses across Europe and has raised over $69 million in funding.